Zimbabwe in race to introduce digital currency

Zimbabwe is in the race to become one of the first African countries to introduce a central bank digital currency (CBDC).

Nigeria became the first country in Africa to issue a CBDC, the eNaira, in 2021 while several African countries such as Botswana, Ghana, Kenya, South Africa, Tanzania, and Uganda are at various stages of crypto regulation and issuance of CBDCs.

CBDCs are digital versions of cash that are more secure and less volatile than crypto assets because they are issued and regulated by central banks. They can potentially be used for cashless transactions, increasing financial inclusion and providing a new way for central banks to conduct monetary policy.

Reserve Bank of Zimbabwe (RBZ) governor John Mangudya expressed optimism with the country’s roadmap towards the adoption of CBDC.

“The Bank’s CBDC project continued to progress steadily in line with the envisaged CBDC Road Map. In this regard, in November 2022, the Bank rolled out a consumer survey that intends to solicit opinions on the design and nature of the CBDC and its overall acceptance/acceptability by stakeholders,” he said in his January Monetary Policy Statement.

“The survey is still open, and the public is encouraged to submit responses online to provide critical inputs to the CBDC Road Map. As of 23 January 2023, the Consumer Survey had received 2286 responses since its launch on 10 November 2022. The Bank is encouraged by the positive responses received so far which will be critical in informing the CBDC adoption,” he added.

Market analysts believe that CBDCs could bring financial services to people who previously did not have bank accounts, especially if designed for offline use.

In remote areas without internet access, digital transactions can be made at little or no cost using simple feature phones.

“CBDCs can be used to distribute targeted welfare payments, especially during sudden crises such as a pandemic or natural disaster,” said Global Renaissance Investments chief executive Ngoni Dzirutwe.

“They can also facilitate cross-border transfers and payments. Sub-Saharan Africa is the most expensive region to send and receive money, with an average cost of just under 8 percent of the transfer amount. CBDCs could make sending remittances easier, faster, and cheaper by shortening payment chains and creating more competition among service providers. Faster clearance of cross-border payments would help boost trade within the region and with the rest of the world,” he added.

There are risks and challenges that need to be considered before issuing a CBDC. For instance, the country will need to improve access to digital infrastructure such as a phone or internet connectivity.

In addition, the central bank will have to develop the expertise and technical capacity to manage the risks to data privacy, including from potential cyber-attacks, and to financial integrity, which will require countries to strengthen their national identification systems so that the know-your-customer requirements are more easily enforced.

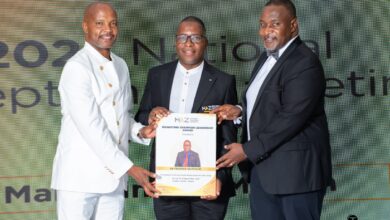

Meanwhile, GRI will next month host a Digital Conference and Awards conference in Victoria Falls where ICT minister Jenfan Muswere will be the guest of honour.

RBZ deputy governor Innocent Matshe is expected to explain how the new currency will affect the private industry for digital payment services, which has made important strides in promoting financial inclusion through mobile money.